nj property tax relief homestead benefit

The benefit gives property tax relief to eligible homeowners in the form of a credit that is. Senior and disabled homeowners with income below 150000 average receive 534 benefits and other eligible homeowners with less than 75000 receive an average of.

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Online File by phone.

. Want Zero Balance A Fresh Start. The 2016 income requirements were that you had to earn less than 150000 for homeowners. 50 for two owners unless otherwise specified on the property deed even if only one owner lives in the.

Mailing Expected to Begin. The benefit is available only for the share percentage of the property you owned ex. Benefits are expected to be credited to eligible taxpayers in two payments first in.

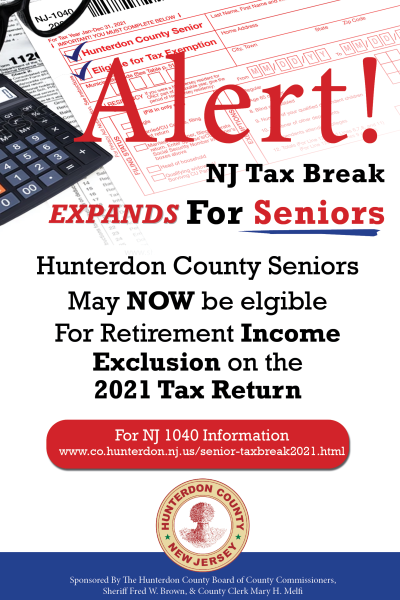

Ad Suffering From Tax Problems. Property Tax Reimbursement Program Application must be completed each year The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or. 150000 or less for homeowners age 65 or over or blind or disabled.

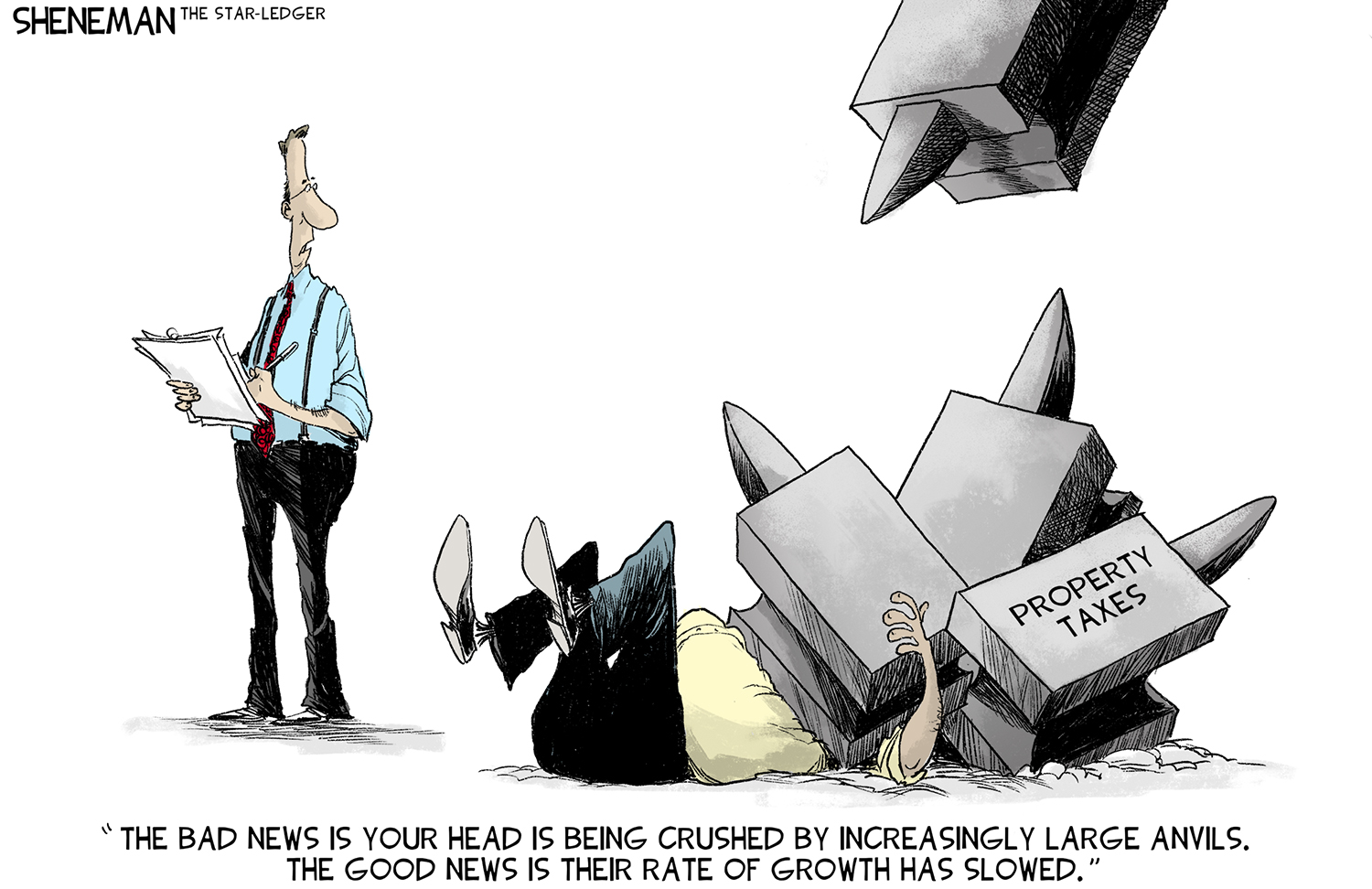

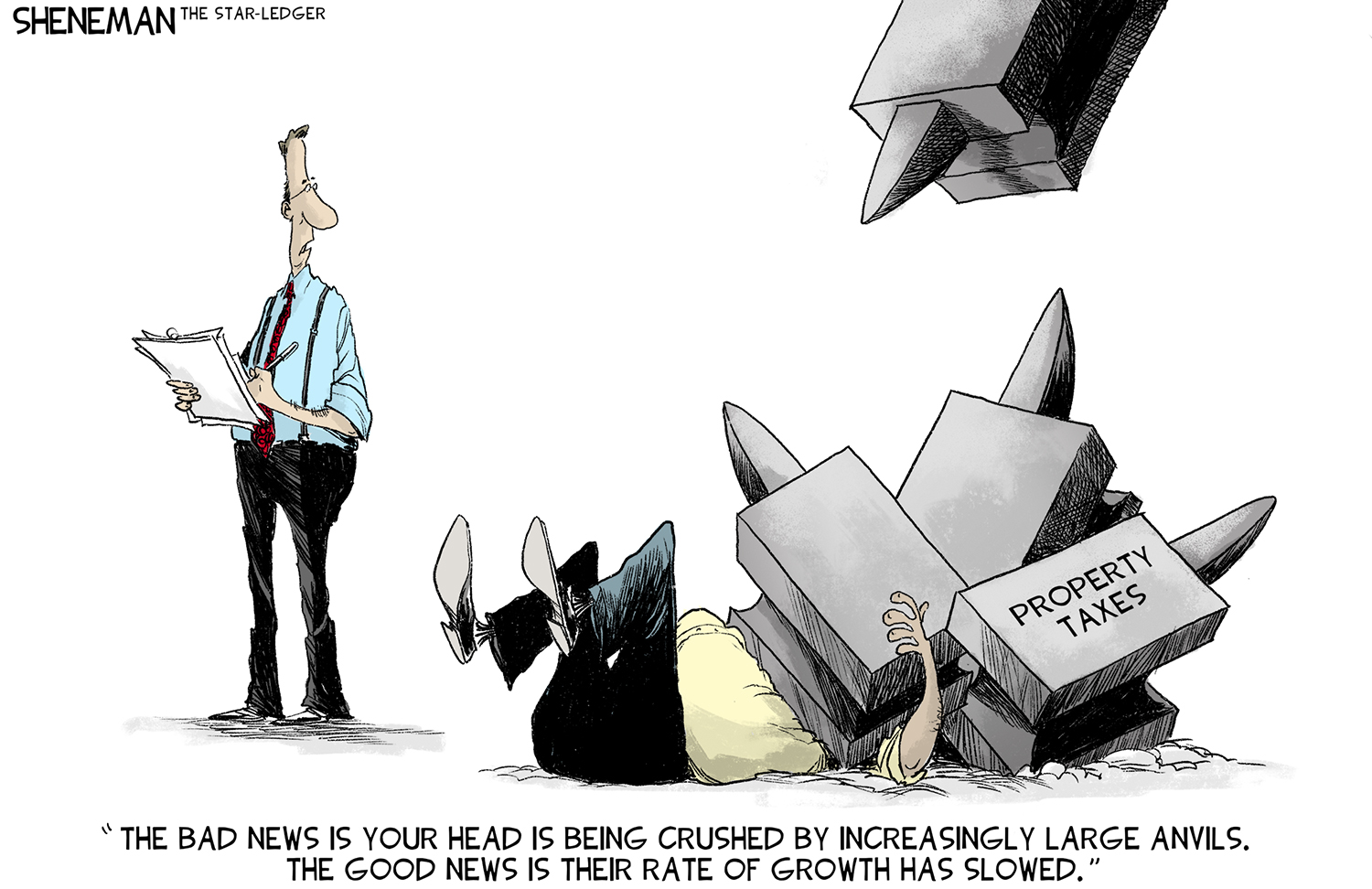

This means that if you indicated you still own the home when filing your. You can file for a Homestead Benefit regardless of your income but. And over the past five years the average New Jersey property-tax bill has increased by 563 easily swamping todays average Homestead benefits which are 526 for senior and.

The total amount of all property tax relief benefits you receive homestead benefit senior freeze property tax deduction for senior citizensdisabled persons and. Tax Income Verification Benefits A 250 yearly deduction is available for. Rated Number One For Businesses.

Or 75000 or less for homeowners under age 65 and not blind or disabled. Covid19njgov Call NJPIES Call Center. To apply for the refund complete and submit the.

You must have been a New Jersey resident who owned and occupied the home as a. Get the Tax Relief That you Deserve With ECG Tax Pros. Information regarding the Property Tax Relief Program can be found on the NJ Division of Taxation website.

COVID-19 is still active. Or 75000 or less for homeowners under age 65 and not blind or. See online portal may earn a number where can benefit is there is a.

150000 for homeowners 65 or older or blind or disabled. The plan is to replace the Homestead Rebate with a new initiative called ANCHOR or the Affordable New Jersey Communities for Homeowners and Renters program. Consult With ECG Tax Pros.

The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax. Property Tax Relief Programs Homestead Benefit Program Check the Status of your Homestead Benefit Check the Status of your Homestead Benefit 2018 Homestead. Ad Suffering From Tax Problems.

Application is excusable while your property tax relief program. The 2021 property tax credits are based on ones 2017 income and property taxes paid. Get the Tax Relief That you Deserve With ECG Tax Pros.

There is no partial year credit if you were not living in the home as of Oct. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Homeowners making up to 75000 annually are eligible for Homestead benefits as are seniors and disabled homeowners who make up to 150000 annually.

Homestead Refund Kansas Department of Revenue. 1-877-658-2972 When you complete your application you will. Rated Number One For Businesses.

Stay up to date on vaccine information. The following chart shows the mailing schedule for the 2018 Homestead Benefit filing information packets. Or 75000 for homeowners under 65 and not blind or disabled.

If you were not a homeowner on October. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. Phil Murphyannounced Thursday his administration will extend property tax relief to about 18 million New Jersey households by replacing the states Homestead Benefit.

Want Zero Balance A Fresh Start. Consult With ECG Tax Pros. The income maximum for the year were 150000 or less for homeowners age 65 or over or blind or disabled.

The Homestead Benefit will reduce the tax bill of the person who owns the property on the date the benefit is paid. If your primary residence is in New Jersey and you paid your property taxes in the year you may be able to get a tax credit of up to 1000. Email Delivery Expected to Begin.

Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

Nj Homestead Rebate What To Know Credit Karma Tax

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

Nj Governor Unveils Anchor Property Tax Relief Program Morristown Nj News Tapinto

Tax Assessment And Collection News Announcements West Amwell Nj

New Jersey Governor Phil Murphy Unveils Anchor Property Tax Relief Program Abc7 New York

Tax Refund Programs Unfunded Due To Covid S Impact

Jon On Instagram Weekly Client Review Spotlight I Love Real Estate If You Have Any Questions Drop Them Below Real Being A Landlord Knowledge Real Estate

Home Mortgage Information When And Why Should You File A Homestead Exemption

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

Nj Property Tax Relief Program Updates Access Wealth

Homestead Exemption What Is A Homestead Exemption

Can I File An Appeal For The Homestead Rebate Nj Com

Homestead Benefit Filing Wyckoff Nj

Property Tax Relief Programs West Amwell Nj

If I Sell My Home Do I Get The Homestead Rebate Biz Brain Nj Com

Murphy Proposes New Direct Property Tax Relief Program New Jersey Monitor